Abnormal in every way, and not sustainable in any way.

The paralyzing terror of running low on cash when you own a small business, and what we can do to stay sane and support local in turbulent times

So, thinking back a few months: how was your Small Business Saturday?

Ours was lackluster.

We staffed up this fall after one of our full-time people quit. We hired two new part-time retail people: one with floral experience, since we’re growing the floral side of the business, and one who used to work at a plant shop (not someone you encounter every day, since plant shops are still relatively new). But our Black Friday weekend sales were 27% lower than what they were last year, before there was a COVID vaccine.

Was it off-base for me to project that our 2021 Black Friday holiday weekend sales would at least equal what they were in 2020?

Here’s what I was assuming:

We have more holiday floral products (wreaths, centerpieces) ready to sell online

People are more used to “the new normal” and aren’t as fearful of shopping in stores this year

Our business hasn’t been terribly impacted by supply chain issues (although we have experienced shipping delays that leave us short on basic terra cotta supplies)

Our addressable audience has grown since November, 2020 (2k more Instagram followers, 1k more SMS subscribers, 1.1k more email subscribers)

We’ve recently remodeled or reset the shops to better display some of our best selling products, as long as we can operationalize keep those products regularly stocked (a challenge maybe I’ll address in future updates)

Still, 27% lower than 2020 sales. On the same weekend.

When it comes to running a small business, you don’t have a lot of time to be perplexed without taking action. I recently re-watched the film Titanic (for my kids, dammit) and got chills watching that scene when the crew realize they’re about to collide with an iceberg. You’re steering an ocean liner directly into a mound of floating ice, and yet to turn the boat just slightly it takes an agonizing number of steps that have to happen rapidly and in the right order to avoid hitting it.

So I found myself sitting at home on the Sunday after Black Friday trying to determine what our agonizing number of steps is and in what order to engage them to avoid the small business iceberg: running out of cash.

This is the part of running a business that I hate. In the movies, everyone looks heroic pulling levers and ringing bells and slamming cast iron boiler doors. In real life, the bell I’m ringing is applying for a line of credit (which looks like getting a mortgage pre-approval, with even more paperwork), adjusting our open hours, and deciding whether we actually need a two-hour shift overlap on weekdays.

I don’t have the luxury of avoiding the truth for very long: we hit the ice, the hull is cracked, the ship will sink in 90 minutes, and there aren’t enough lifeboats. As the captain (you’re letting me run with this metaphor, right?), I have to come to work Monday with a plan to put into action right away, and I have to set aside my personal reservations about hurting people’s feelings if they don’t get the scheduled shifts they were hoping for.

[Side note: it helps if you’re not running around the deck making out with Leonardo DiCaprio while the ship crashes, but in real life I’m somehow both Rose and the ship’s captain, trying to iron out a sometimes dramatic set of personal issues while also spreading out blueprints with the ship’s engineer, trying to avoid disaster in all places all at the same time. That’s real-life business management for you!]

You may roll your eyes at the ocean liner metaphor (especially now that I dragged Rose into it), but thinking about running a business like a steam liner or a nuclear power plant helps when I have to navigate contingencies. When things start looking grim, instead of charging ahead without making any changes, blindly hoping things will just work out, I’ve tried to develop tactics that slowly right the ship without freaking everyone out. I call this “pulling levers.” It’s a little bit like pulling out the emergency manual during a crash and methodically going over every option to see if any of your small adjustments help you regain predictability over what’s happening. It’s the minor tweaks, and not running around screaming, “we’re going down, we’re going down!” that work here.

Pulling levers is not my favorite thing to do, but it helps that I have a firm grasp on my numbers, on what our benchmarks are supposed to look like, and how far off we were from hitting them. I’ve also thought prior to this weekend about what small adjustments we can make if we don’t hit our targets. So it all feels very controlled even though inside I’m freaking out a little. (Don’t worry, I’m always freaking out a little — it’s called entrepreneurship.)

So if I can offer a little piece of advice to business owners based on my own handful of years of experience, it would be this:

Don’t ignore the scary stuff.

The most terrifying thing that you’re absolutely afraid of looking at? Look at it. Don’t pretend it isn’t there. The only way you can fix it or keep it from happening or control the damage when it does happen is to realize how bad it is, or how bad it could be, and start realistically planning contingencies. Make this a regular practice and it won’t seem scary after a while.

Get inspired by this other scene in Titanic where the captain and engineer get real frank about what’s about to happen. (“She’s made of iron, I assure you, she will sink.”) And remember: you probably have more than 90 minutes to plan your way out.

Okay but here’s the other thing.

We’re dealing with an unprecedented degree of uncertainty everywhere. Ship captains—seriously I’m all maritime metaphor right now, get on board with it—are used to measuring the same things and taking the same readings over and over again to keep a relatively predictable grip on the navigating the vastness of an open ocean. It’s all heading and speed and wind direction. Retail businesses is the same! Usually. Seasonality, weather, sales, etc.

But now I’m asking myself things like, “Did we have a huge spike in sales in April of 2021 because people were excited about getting vaccinated and getting stimulus checks? Or is that our normal seasonality?”

“Did the Omicron variant keep people home on Black Friday?”

“Will the price of shipping containers and raw materials stay this high? And when will our vendors pass those costs on to us?”

Not normal. Kind of like a freak storm that forces you to throw everything you think you know about sailing out the window.

At times like these it helps me to remember I’m not alone.

This recent article in the New York Times about the boom the furniture industry in North Carolina is experiencing describes how a surge of interest in your product can also create uncertainty and missed opportunity.

People stuck at home during COVID ordered more furniture. Chinese factories were back ordered and shipping wasn’t happening, so people ordered domestically. But uh, those furniture production companies in North Carolina? Scaled back years ago when production went mostly off-shore. (If you want to read more in-depth about that, I recommend The Furniture Wars by Michael Dugan and Factory Man by Beth Macy. Fascinating shit, honestly!)

Now we have peak demand but not enough workforce to fulfill it.

The Times quoted Alex Shuford, chief executive of one of the Carolina furniture brands: “The surge isn’t going to last as long as it would take to go to a completely trained work force and get them up to speed.” The current moment, he adds, “is abnormal in every way, and not sustainable in any way.”

[Additional side note: if I ever decide to pull a Julie Powell and pull some dramatic relationship antics while learning a skilled trade, please remind me that this place exists.]

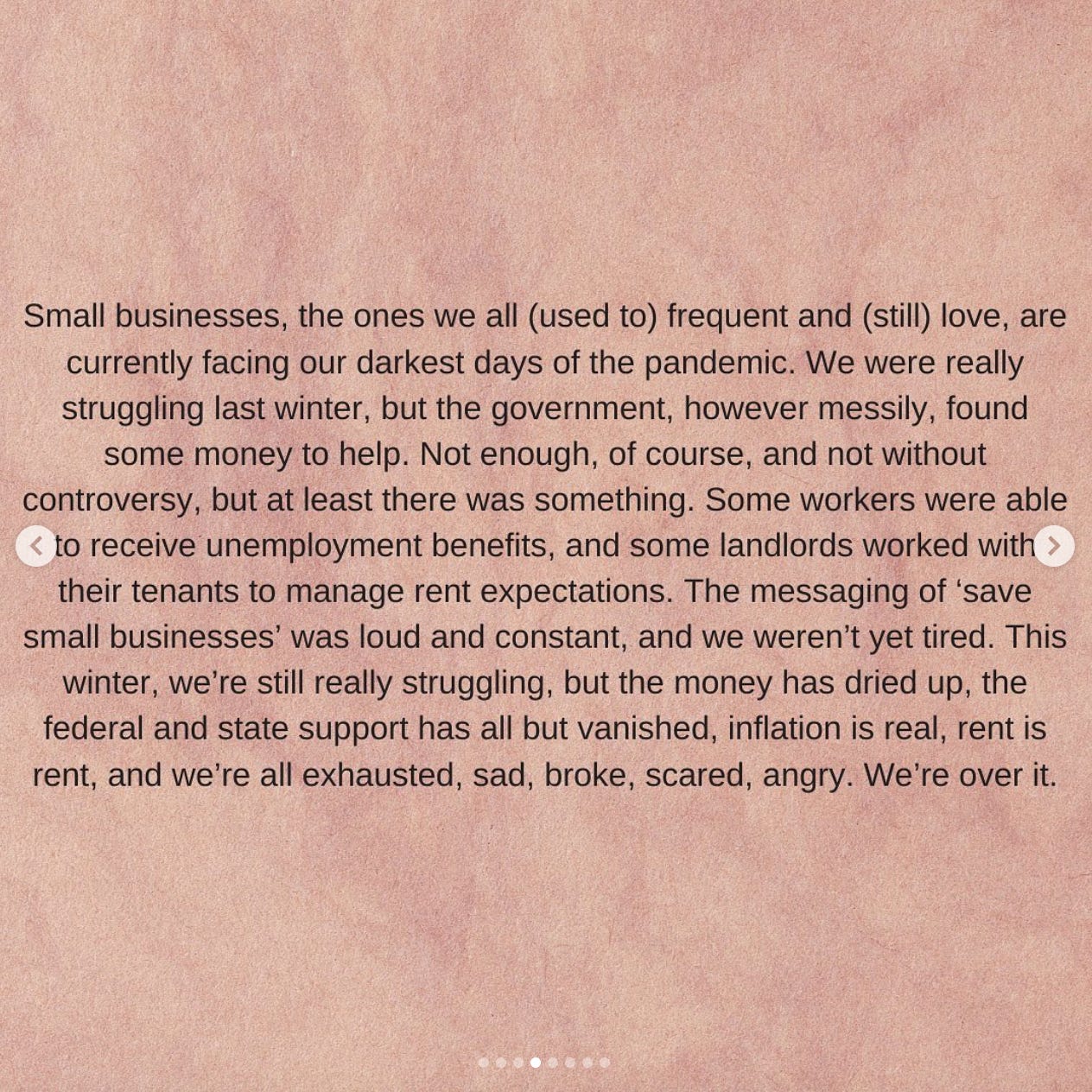

Really, we’re not alone. A friend of mine recently shared this Instagram post from Bar Norman in Portland with me. It’s worth a read. The problem we’re facing now, in January 2022, is that we’re all facing the same set of circumstances we were a year ago, only now with less governmental support!

Last fall one of our staff tested positive for Covid. At that time, the government was offering emergency pay for people who had to self-isolate or to care for a family member. This past month, two more of my staff had to isolate. Not only has the CDC updated its guidelines for isolation periods (a life-or-death landscape every small business owner has to navigate every single time this happens because the guidelines keep changing), but the government has stopped reimbursing businesses for emergency payments for quarantine and isolation periods. So my staff have to use their accrued PTO to pay for this time off, and our business is no longer reimbursed for paying it out.

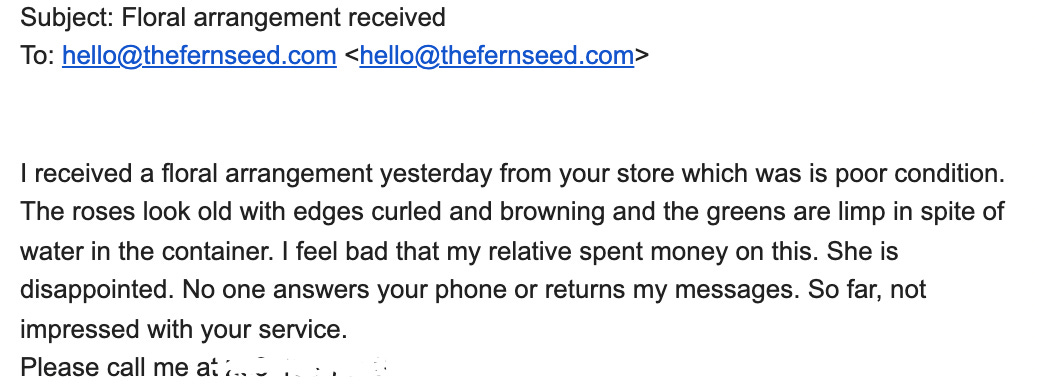

While this is happening, those of us who work in customer service are dealing with customers’ increasing pandemic fatigue. This presents itself in various ways, like people refusing to wear masks, or just the general sense that a tiny plant and flower shop in Tacoma should be performing like it’s business as usual, hitting all the marks you would expect despite global supply chain interruption, constantly being sort staffed, and wild fluctuations in revenue as people navigate shifting virus variants.

(In our defense: the roses were reflexed, which is a thing.)

We are not Southwest Airlines here. We’re not too big to fail. Some days we can’t even find drivers to take our deliveries out and I end up driving them up to Seattle myself with my kids in the car. (We use a third-party gig economy service to handle our deliveries—not something I love, but it’s the economic reality of a business our size—and some days drivers just don’t feel like it. And who can blame them?)

All this while I’m frantically trying to rearrange shift schedules to accommodate staff who are isolating, trying to track down a test for myself, while also applying for that small business line of credit, and oh guess what: they just closed my son’s daycare for a week because—you guessed it!—Covid.

And I’ve got to maintain a smile whenever I’m on the retail floor lest we sustain another face-policing Yelp review. (At least the ship’s captain’s doors close and lock! No one expects the pilot of an airplane experiencing extreme turbulence to also serve drinks in the cabin, but that’s my job every day!)

You know why I’m lucky? Because these are the problems I want to be solving. I want to be a business owner. I always wanted to have a retail shop. But navigating this for two years wasn’t exactly what I signed up for. And if I’m getting fatigued? I know there is not a small customer-facing business out there who hasn’t thought about cashing in their chips at this point.

But we can’t let that happen. Small businesses in this country really are too big to fail. At their best, they are what make places places. We love our corner coffee bars and plant shops. We love a brunch place, and a place to shop after brunch. And a wine bar, and a little bowling alley with murals on the walls, and a two-screen movie theater that plays Rocky Horror Picture Show every first Friday at midnight. We love a place that staffs real people, who can answer our questions about what shoes we need for specific rock climbing activities, or what comic we should buy next. If these places can’t sustain themselves through turbulent times, we’ll end up with a bunch of cell phone screen repair shops and boarded up storefronts. (And we’ll still be paying obscene prices for homes.)

If you’re in business right now, my best advice is to figure out the ways you can attempt to run your ship on low power (I’ll do an entire post on this in a future episode). If you’re a customer who loves small businesses, Bar Norman had a great list of things you can do to support local even if you’re not leaving the house.

I also posted a list to my Instagram on American Express Presents Small Business Saturday:

Eat at locally-owned restaurants and don’t Door Dash — call in your order and pick it up or dine-in.

Buy food, soap, etc. at farmer’s markets. Make one farmer’s market a regular week/day/end habit.

Buy at least some of your groceries at the co-op.

Buy lumber, tools, and hardware at a local supplier or hardware store.

Don’t use FTD/1-800-Flowers. Call a local florist in the town where you want to send flowers to and inquire about delivery.

Drink local coffee most of the time. Resist the Starbucks app! (I know it’s hella convenient.)

Figure out how to order books and music from a local store — they can usually order anything for you and lots have websites. Switch over from Amazon.

When you browse in a small shop, buy something small, even a greeting card or sticker. Think of it like a tip.

Follow your favorite places on social media.

Write positive reviews for places you like. Never leave a negative review. Like, ever.

Shop owners love it when people say things like, “I love your store,” and “I’m glad you’re here.” On bad days, it makes a difference. Don’t be shy!

Make a regular habit of buying something local. We have a realtor who spends $50-100/month on floral arrangements for closing gifts with us. I try to buy all kids’ gifts locally.

Go to pop-up markets! Outdoor ones!

If you like a product you bought at a little shop (like a hair product or candle) and you want to buy it again, buy it from their website.

Get things like birthday cakes from local bakeries.

Shop for beer and wine locally and not at the grocery store (unless it’s the co-op).

Instead of ordering from a company’s website, check their Stockists page and see if it’s available locally (some local shops will ship too).

Local movie theaters! Instead of the big ones.

Get your hair cut at a local biz and not a chain.

Get stuff printed locally instead of the big online print places.