Let's talk about terrifying business debt.

I paid off a massive, semi-predatory loan this week. Celebrating. Sort of.

I was reading back through my journals from three years ago and woah, it's like a different person wrote them. In an entry from August, 2019, I'm unselfconsciously writing about maintaining a morning routine with a kind of pre-pandemic optimism that centered my personal habits as the gateway to a happier, productive life. Remember that innocent time when we all thought we were a yoga class and a completed to-do list away from entrepreneurial transcendence? Sweet Jesus how times have changed.

In that August entry, I'm writing about goals (hah, remember goals?), and one of mine was to pay off the initial startup costs of the business ($40k family loan and roughly $25k on a business credit card), while maintaining a savings buffer. And I was doing it! I was steadily paying a zero interest credit card down to a zero balance before the introductory rate expired while stashing hundreds of dollars a week into a savings account so I could maintain a cash buffer for the business in case of emergency.

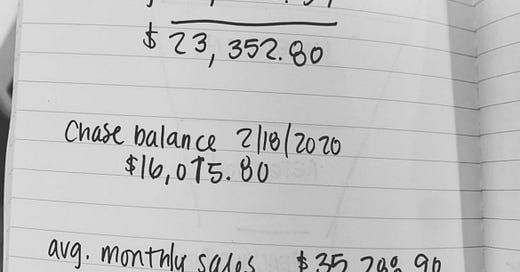

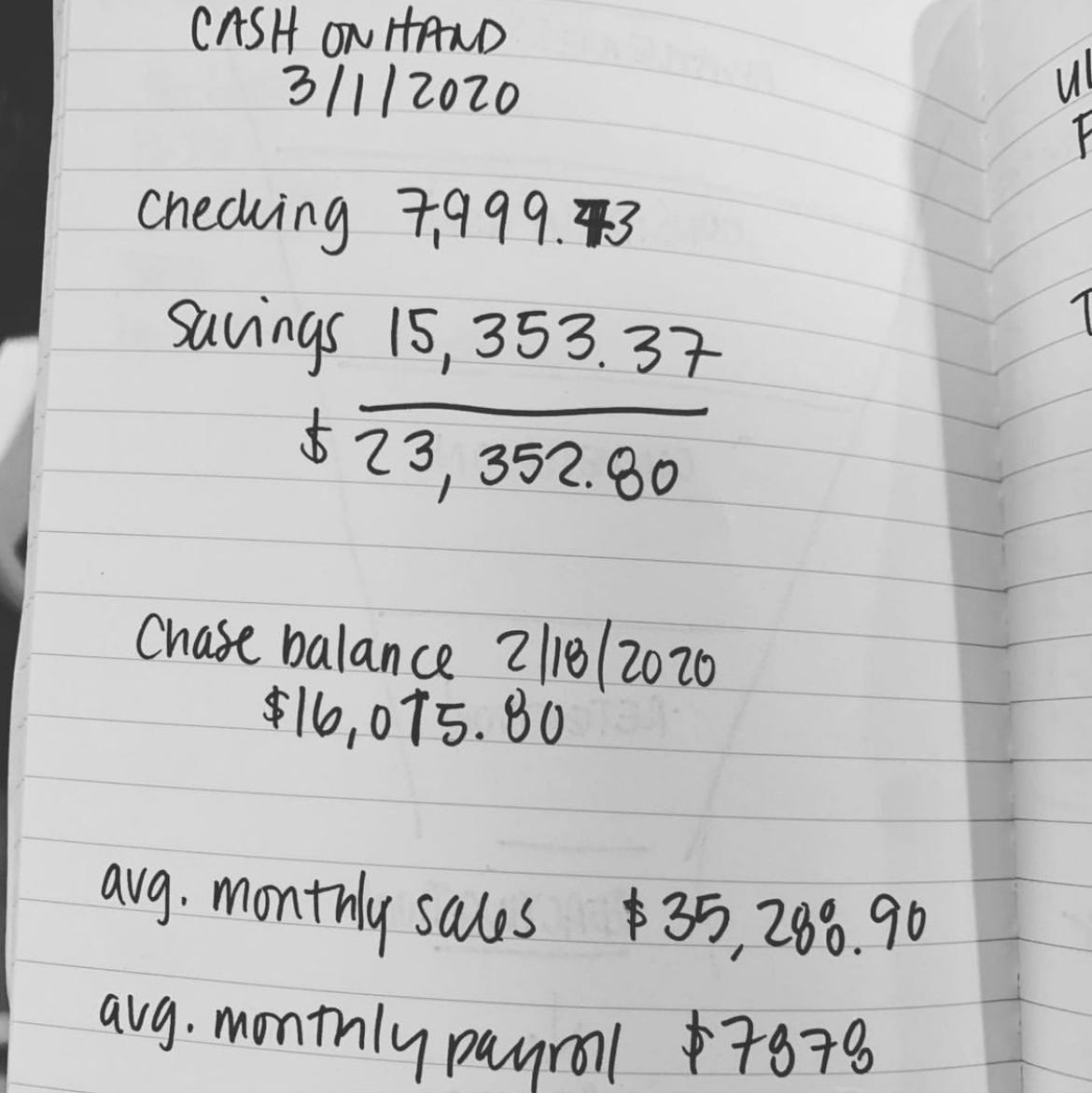

On March 1, 2020, when it became clear we were going to have to shut down for Covid, I had $7,999.73 in the business checking account, $15,353.37 in savings, and the remaining startup balance on our Chase card was $16,015.80. We had $7,337.00 in equity with average monthly sales of $35k and monthly payroll of $8k. Not a lot of runway, but boy did those August, 2019 savings goals carry us through the first several weeks of shut down. There is nothing more comforting to a small business owner than having cash in the bank!

More comforting still were the loans we got from the SBA (EIDL loan), PPP, and City of Tacoma, which totaled around $100k—cash that was almost immediately in the business bank account and more money than I'd really ever been in control of in my adult life. I knew that in order to stay viable in the volatile pandemic aftermath, our business would have to shift operations to be more delivery focused, which meant we were going to continue to sell flowers, and to do that, we needed more space. So in September of 2020, we opened a second location. Having that much cash in the bank gave me a confidence I did not deserve! This was the beginning of our arterial cash bleed, the main cause of which was poor management on my part.

I wrote previously about killing your darlings, and how I spent huge chunks of cash on projects that never fully materialized. I also engaged in aggressive "cart-before-the-horse" people management, hiring and promoting staff in anticipation of the increased workload that never happened—or at least happened way more slowly than I planned. Then I made an even more terrible financial management mistake in May of 2021 that almost tanked my business. After three months of steady sales growth resulting in revenue that was 20-30% higher than what it had ever been in the history of the business, I adjusted our payroll to reflect those sales, a commitment that is near impossible to reverse, and to further hammer nails into the lowering coffin, I used our cash on hand to pay off a big chunk of one of our existing loans when it was not required. Almost immediately after I made those decisions, our sales readjusted to normal levels. My credit card balances skyrocketed, the cash in the bank dwindled, and I started getting really nervous every two weeks about how we were going to make payroll.

I assumed sales would eventually rebound, especially because I was paying all these people to do all the things that were supposed to grow the business. So in June of 2021, it seemed like a really smart idea to take on a Shopify loan. This way I would have a cash buffer, so the management mistakes I'd made could work themselves out over time (because they would eventually, right?). If you have a Shopify business, you may have received these funding offers already. They're pretty sweet. They don't affect your credit, the cash is deposited immediately, and they require almost no paperwork to complete. Shopify offered us $135,000 in cash at something like a 9% rate, paid upfront. Within a few days I had that cash in the bank. The only catch? With Shopify loans, your payback schedule is set based on your daily sales. In our case, 17% of our daily revenue would be withdrawn until the loan was paid back. (Do you watch Shark Tank? This is like a Kevin O'Leary royalty deal.)

I figured with $135k in the bank we would be fine! What was 17% of daily sales with that much cash on hand? I couldn't possibly spend through it all before we became profitable again, right?

But by October of last year, I was in meetings with a local bank trying to open a line of credit just in case. By early March of 2022, I was dipping in to that line of credit to make payroll. (I had long since ceased paying myself.) By late March of 2022, I was pulling $2,500 from my home equity line of credit to pay my staff because that was the only place I had liquid cash left. This is the nightmare of using a second mortgage to finance your business mistakes, and I was living it!

All the while, 17% of whatever sales we did have were disappearing back to Shopify, and to top it off, all but one of our shop credit cards (we have three) were completely maxed out, totaling close to $100k in additional debt that was rapidly accruing nearly $500/month in interest.

It's June now, and as of this week, that Shopify loan is fully paid off.

I have cash in the bank again, and I am starting to pay down the credit card debt.

I haven't started paying myself a regular salary again, but I've set aside close to $1,500 in owner's compensation and am adding to it each week so I can resume paying myself with confidence soon.

Most importantly, I am able to make payroll, pay our sales tax, and pay our contractors and vendors on time and without stress. I haven't bounced a check or incurred non-sufficient funds fees in over a month.

How did I get here in just three short months?

By doing unimaginably hard things that, with a little bit of practice, got easier.

Starting in the fall of 2021, I stopped pretending like things were fine. This is when I secured the line of credit from our local bank before I actually needed it.

I stopped making wishful projections and started looking at the real numbers. Looking at the real numbers is terrifying, like why-is-Mike-standing-in-the-corner-facing-the-wall-at-the-end-of-the-Blair-Witch-Project terrifying, but you have to do it. You have to confront the brutal facts of your reality if you are going to do anything productive about them. I looked at the numbers, they were bad, and I started making a plan.

Part of that plan included making adjustments to payroll. The first part of that, ceasing to pay myself, was easy. The second part, which for many businesses can include layoffs, is one of the hardest things anyone will ever have to face as a business owner or human. To have to tell someone they are losing their job and source of income because of stupid financial mistakes you made as a business owner? I would rather cease existing, but I've had to do it. I did not have to do it in 2021 only because of turnover we were already experiencing. Some of our staff left of their own accord, and I was spared that agony. But it also meant letting our current staff know that we weren't hiring to fill those roles, and they'd have to add more work to their plates. (The silver lining here is that I was able to offer modest raises based on real financial projections, and will continue to do so incrementally as I become more confident that the business can support the payroll.)

The most important thing I did, though, in facing the near financial collapse of everything I'd spent three years building, was to ask for help. Believe me, I was fully ready to strap on the business owner cone of shame and sit in my bathroom hiding from the world hoping this would all go away, but I had a moment of clarity.

I own a business with two locations that generates nearly $850k in revenue each year an employs between 6-8 people in a small city. These are weird times. I made mistakes, but they are not irreversible. I'm human. It's okay to admit that I don't know what to do and I need help. So that's what I did.

I called the business financial liason for the City of Tacoma and I called my business banker. I told them exactly what the problem was. Within hours they were both getting back to me with options for debt restructuring. They were both objectively able to assess my situation and see it for what it truly was: I have debt that's accruing too much interest all at once, while an additional loan is pulling out a large amount of my available cash, and I simply need to finance the existing debt in a way that allows me to conserve more cash without incurring such massive finance charges. Within a week I had applied for and secured a loan that would pay off my existing debt and could be repaid slowly, with much better terms.

Restructuring debt is one thing, but it still doesn’t mean you’re running a profitable business.

Remarkably, I didn't end up using any of the new financing to pay off the Shopify loan, because in addition to reaching out for help, I started implementing the Profit First system in my business. I wrote about the book Profit First in my post last week. Within a week of reading that book, I had put most of the core principles to work in my business.

I cut extraneous expenses, including rent on an office space I didn't really need.

I opened separate bank accounts so I could allocate funds to important expenditures like payroll, cost of goods, sales tax, and debt repayment before those bills came due.

I looked at ways in which we could maximize profit on revenue streams we were already making money on, so we could increase revenue slightly across several channels that are already winning for us.

I set aside a small percentage of our revenue every two weeks to ensure that I can pay myself and put profit back into the business, so I don't burn out.

Anyone who has known me for more than a week is probably aware that I am absolutely obsessed with the story of the Andes survivors, the plane that crashed in Argentina in 1972 on which the book and film Alive were based. (How obsessed? I hiked to the crash site in 2019 with one of the survivors? Yes, I did that.)

There's a moment in that story when the two survivors who hiked out of the crash site reach the end of the snow line after walking for almost a week. After two months of near starvation and death, this is the first time either of them has seen grass. They have no idea where they are and they have not yet reached help, but one of them falls to his knees, touches the grass blades and says, "This. This is the line that I might live."

This week feels like a celebration. Paying off that Shopify loan means something massive to me. It is the line that I might live.

I share this with you because I know how isolating it is, how petrifying it feels, to face the mistakes that could lead you to financial ruin and we all think we are facing it alone. We are not.

I am not writing a blog about running a retail shop because I have it figured all out. I'm writing a blog about a running a retail shop because some days I am scared shitless and writing about it is, for whatever reason for me, the path I take to the snow line. This work is incredibly hard, and it's incredibly important, because without those of us who venture into small business ownership we would not have small businesses at all. But the reality is we are incredibly underfunded, and so a few small mistakes can compound into disaster very quickly. Don't let it happen! You are worth staying in business it that’s what you want to do.

So, listen: if you're going through some terrifying business shit, financial or otherwise, and you feel like no one is around to help, I want you to email me. I'll even give you my WhatsApp, you can leave me a whole long voice message about it and I'll voice message you back. I'm not kidding! DO IT. I am here for you.

Now I am going to find a very modest way to celebrate this very momentous day. Today is my snow line.