The story of closing a location

We are officially closing a location, something I thought I would never do, and I feel great about it.

As I was preparing to publish this post, our business neighbors on South Tacoma Way, Howdy Bagel, announced that Jake Carter, one of the shop’s cofounders, was tragically killed in New Orleans. Howdy opened just 7 months ago down the street from Fernseed. I got to know Jake and his husband Daniel as they considered South Tacoma as a potential location for their bagel business. I was looking forward to many years of having them as neighbors, as they’re some of the warmest and most genuine people you’ll ever meet. I’m still in shock, honestly. But I wanted to share this news because this newsletter is going out to a community of business owners who can only imagine—but perhaps have somewhat firmer grasp on—what Daniel, Jake’s husband and co-founder, is now facing, which is to continue to operate the business in its infancy while navigating the grief of losing his partner. They’re closing temporarily and hosting a GoFundMe to help with cashflow.

Last month, the day after Christmas, I publicly announced that Fernseed will be closing its Proctor location permanently as of January 15.

This decision is long overdue. For three and a half years we’ve had two locations in the same city, struggling to make it work. Our Proctor shop has often felt to me like a relationship that just feels… over.

I can't even believe I'm writing this, because at points along the way I was certain I was tethered to Proctor forever. It was always the money maker, the cash cow!

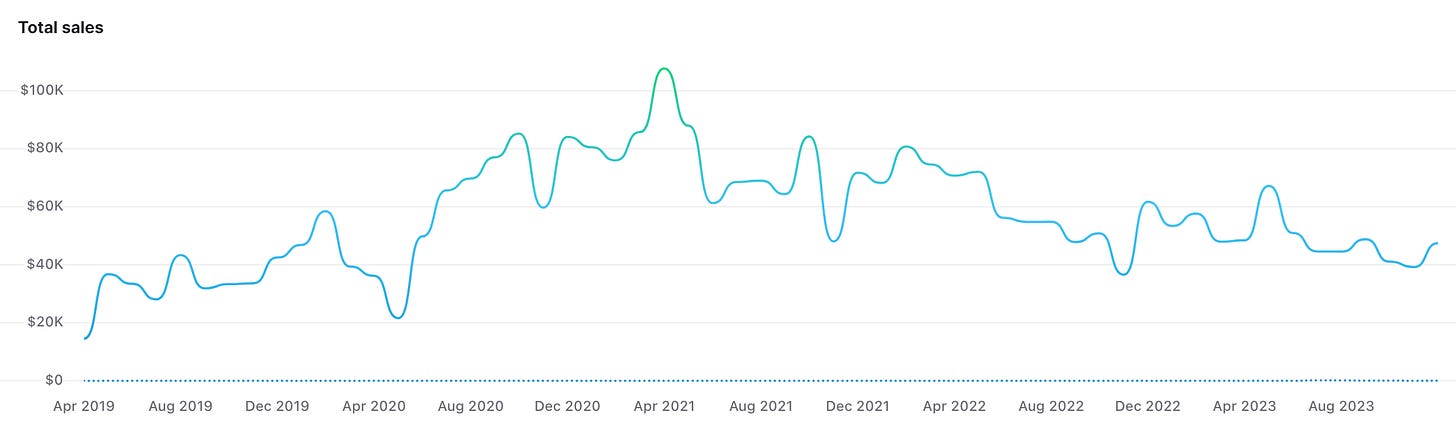

Then, in early 2023, our South Tacoma shop started unexpectedly eclipsing Proctor in daily in-store sales. Watching this happen, I felt like I was cheering on an 80-1 odds Kentucky Derby horse as it moved up the center to overtake the favorite. I needed South Tacoma to start making more money than Proctor so I could finally have a financially sound reason to oxygen starve Proctor and consolidate. I frankly didn’t think it would ever happen.

Proctor is in a high foot traffic, high income area. South Tacoma is in an average income neighborhood that’s experienced years of downturn and is just now rebounding. The South Tacoma shop is bigger, but when we opened it in 2020, 18 months after opening Proctor, we anticipated using it more like a warehouse than a storefront.

Seeing that South Tacoma—which used to gross only 1/3 of what Proctor would gross in a single month—had the potential to carry the entire business was the final piece of the puzzle for me. The pain of continuing to be stretched too thin operationally and emotionally running two locations was finally greater than the fear of financial ruin if we closed one. It was time.

So why did Fernseed ever have two locations in the same city, and why did it take so long to decide that closing one was the right idea? Not just the right idea, but an idea that might actually save the business?

How we went from one to two locations (and why you should probably never do this)

I have always been keenly aware that having two locations in a driveable city like Tacoma doesn't make sense. We're not exactly expanding our customer base by locating a slightly larger version of the same shop 5 miles away from the first one. Customers would (probably) drive to us either way. But I made a rookie misstep in choosing the first storefront: I picked a shop that was too small. We opened South Tacoma primarily because we needed more storage and processing space.

Outgrowing your first location

Proctor is only 750 square feet. There is no back room for storage, only a closet. This was a problem the moment we started selling inventory fast enough to order pottery by the pallet. (Try unloading a pallet of pottery into a coat closet that's already half full of pottery and you'll see why I wish I would have been less conservative in my initial lease signing.) Yes, Proctor is a high foot traffic area. Yes, one of the city's most popular farmers’ markets is located across the street every Saturday. Yes, it was nice to pay just $1,975/month in rent on a space that once averaged $45k or more per month in sales. But the hassle!

There was also never enough room to take product photos for the website, something so important during the pandemic. We used to shoot outside on the sidewalk. Again, the hassle!

Probably my worst error in judgement when selecting the initial space, though, was that Proctor has only a single bank of west-facing windows at the front of the shop. I thought we could make it work, but we've always struggled to keep plants thriving at Proctor in the dark Pacific Northwest winter.

That’s the tricky thing about picking a space before you’ve run the business you’re planning to open: you’re not sure what your operational needs are. Once you’re aware of those needs, you’re already locked in to a 3-5 year lease. In that situation it’s easy to imagine expanding to a space that fits, but I strongly urge any business owner to sit and deal with the imperfection of it, something I obviously didn’t do.

The first few years of business are too early to expand. Staying put is a conservative decision that, while frustrating, will pay dividends in efficiency that lead to cash savings. Trust me on this, I learned the hard way.

I see a lot of businesses making this mistake. They either want to open the same concept in a new geographic region, or open a different concept in the same region, especially if, even in an imperfect space, they’re making money.

That was probably my biggest error in judgement in the decision to open location two. I mistook Fernseed’s initial success for a guarantee of sustained success.

The siren song of early success

I believed we would achieve sustained success because—and this is important—I believed I was 90% responsible for the initial success. And why wouldn't I take credit? I am really good at developing concepts and launching them! If you are also good at generating buzz, you might find yourself in a business where initial demand exceeds your capacity. In that case, it's natural to think you’re a genius and you should harness that demand into growth.

You may have also come to the conclusion that the only way to increase revenue to a point where it can actually support you, the shop owner, as a primary household earner, is to expand capacity. Even if a shop is making $350k per year in revenue, you may only be able to pay yourself $40-50k between salary and profits, which, in an average American city, isn’t enough to live on solo. The logical math here is that if you double your footprint, you’ll double your pay.

But don’t assume those long lines of eager customers—or your revenue—will double if you expand your footprint unless you already have a decade of experience of opening and (important! 👉) managing multiple locations.

The skills required to successfully launch a profitable first location don’t translate to the ability to successfully manage two. This is because the factors that spurred your initial success may be macroeconomic, and therefore not within your control and not predictably repeatable. In a small business, by the time you come to the horrifying realization that "what got you here won't get you there," you may already be too over leveraged to backtrack.

With two locations you have additional loans to repay, more equipment to make payments on, higher payroll, more rent, and double the cash tied up in inventory. Most of those payments are difficult to decrease quickly if sales decline. It’s like adding train cars to your freight load. The more you pack on, the harder it is to slow down.

I was so attracted to the shiny object of finding a storefront that better met our needs, and to the possibility of doubling my salary, that I didn’t consider any of that when I signed the lease at South Tacoma Way in the midst of the pandemic.

While my official story of opening a second location has always been that we needed more space to expand our floral business and process online orders (and that is true), with 20/20 hindsight, I wonder what my life would look like had I not been so eager. Would I still be paying myself a salary? That looks pretty good now compared to paying myself nothing so I can chip away at the debt I incurred after opening that second location.

What I failed to consider, because I didn't have enough experience running the day-to-day operations of a business yet, was that while I'm good at coming up with and marketing new concepts, I wasn’t that great at operations, delegation, or people management. Turns out these are key skills involved in managing a multi-location business.

The terrible two (locations)

Things came to a head almost as soon as we opened location two. I had no idea what I was doing, and it showed. I was a terrible manager. I rewarded people who took things on without instruction, yet never explicitly said why. It was embarrassing to admit I had to rely on people who didn't expect me to define—let alone help them manage—their workload or process. I told them it was okay to fail in the process of figuring it out, thinking that because I have a tolerance for risk and was giving them permission for a similar tolerance, they'd cultivate it. But that's not how the human brain works, especially during an already stressful global pandemic.

Did I realize the error of my thinking and respond by rolling up my sleeves and fixing my management style? No! I didn't have to because we were making so much money. By now it was 2021, we had two locations, and we were raking in $80-100k per month in sales. I ever so wrongly assumed (again) that it was because I was a visionary, and I had done things right by doubling our retail footprint.

Fernseed did $302k in gross revenue with $47k in net profit in 2019, the shop’s first year. In 2020, the year of the pandemic and when we opened the second shop, we did $650k in gross revenue with $6k in net profit. In 2021, even though we did $828k in gross revenue, the net profit was $2k. I was spending as much money as I was making.

That became a problem in 2022 when our sales decreased to $650k again and the net loss was a whopping $155k.

Nothing will sober you up like a hundred thousand dollars in net loss, especially when you're financing those losses by taking out a second mortgage. How many plants do you need to sell before you can walk away from this business debt-free?

The slow crawl out

It wasn’t my genius that generated those hundreds of thousands of dollars in revenue from 2019-2021, I was just in the right place at the right time. By the time I realized just how much of that revenue was tied to the surge in post-pandemic spending, I was spending too much money across two locations to quickly adjust expenses in line with the rapid decrease in revenue once the economy constricted.

The horror of that, and of almost losing the business, was the thing that finally compelled me to take a hard look at what an ego-driven maniac I had become, to be willing to admit I had failed, not in business (yet), but my team. I failed to show up, to set clear boundaries and goals, to enforce standards, to define what work had to be done and by whom. I didn't get the chance to make things right for the people who quit, but I was determined to change for the people who stuck around.

Over two years, I cut nearly $150k in operational expenses from the budget. This was a difficult, slow process. Many times I should have cut staff but couldn’t bring myself to do it. One the one hand it’s just a difficult and tragic decision, but on the other hand, we often needed more people just to cover the second location.

Each month I'd look at the income statement with dread. More losses! I wasn't cutting fast enough.

Whispers of a solution

"What if you closed one of your locations?" asked every smart person in my life.

"I can't, you fool!" was my unfortunate response pretty much every time. "We require the shop at South Tacoma to maintain all our operations, but the Proctor shop makes half the revenue! I have to maintain both of them or the business will fail."

"Then maybe it's not a sustainable business?"

It's not like I hadn't thought of closing both locations, except I had amassed over $300k in debt, all of which required a personal guarantee, so if I filed business bankruptcy or liquidated everything, I'd probably still end up with $150k in personal debt that I'd have the joy of paying off while searching for a mid-level marketing job.

Then I started hearing location-closing stories from other business owners who had also run two locations and ultimately closed one.

"Best decision I ever made."

"Saved my life."

They had felt as trapped as I had. Some of them had also consolidated into the second location they opened, not the first, because the second was more functional.

If they had done it, couldn’t I?

Humility is a funny thing. Once you start cultivating it, you notice how many times people offer you advice that actually applies to you, how the people you surround yourself with often have better ideas than you do.

The final straw

I had been struggling to make payroll for what felt like 23 years when one of our staff, who was primarily responsible for retail coverage at our Proctor location, put in her notice. Our general manager suggested that rather than re-hire her position, maybe we just… close Proctor two days per week?

I can’t begin to tell you how unnatural closing a retail shop for two days each week felt to me. For four years I had fought to ensure we kept our doors open 7 days a week, even when it meant canceling my own plans to fill in at the last minute for anyone who called out. You’re paying the rent, right? Even on your slowest days, isn’t it worth the $250?

But when our GM said those words: “just close Proctor,” something deep within my body let go, like a chiropractic adjustment of the soul.

Closing is easier than staying open

Closing those two days each week opened the floodgates of possibility of closing the location entirely. It was the experiment that answered questions like: will people drive 5 miles south to the other shop? Many will! Does reducing the cognitive strain of managing the staffing and logistics of two shops have a positive impact on everyone’s mental health? Yes!

Closing two days a week also made it easy to not rehire staff when people quit, so through a process of natural attrition over 6 months, we right-sized the team for a single location. This means I won’t have to lay anyone off or reduce hours to close Proctor, which makes the decision easier.

The final deciding factor was simple: our lease is up in April of 2024. When it came time to renew, I just didn’t exercise the option.

Logistically, it’s fairly easy to close a business location. If you’ve ever moved a household, you can do it. It’s annoying, yes, but it’s not hard. Not as hard as running two locations, that’s for sure.

Closing a location is not a failure

It’s unfortunate that we think of “location” as such an irreversible thing, especially when so many of us started in pop-ups or doing markets. It’s not 1974! Most businesses (for better or worse) don’t hunker down in neighborhoods for 38 years anymore.

I’ve been thinking that a smarter path toward successful, sustainable retail businesses in a neighborhood is more of a planned itinerancy. Make a plan to launch a concept for 5 years, then reassess and launch something else if that concept is stale after half a decade. Why isn’t that the norm?

We need to detach ourselves from the traditional notions of success that motivate other industries, or that may just be archaic at this point. I can’t tell you how many times people have suggested that I franchise Fernseed. Isn’t that always the way? Success has to be replicated, exponentially! I don’t think anyone who ever suggested that had actually run a storefront retail business. Those that have know that often, the pursuit of growth is the thing that kills you.

What I’m aiming for now is predictability. And profitability, however meager.

The path forward

Liquidating an entire location means we’ll have the temporary boost of selling inventory we needed to sell off anyway. The cash we free up can stay free, too, because we don’t have to sink it into the $30k in inventory it takes to stock an entire location.

We’ll save on rent, software, payroll, supplies, and most importantly, hassle. We’ll be able to focus our energy on one shop that provides the full brand experience, something that was so often fractured between two locations.

I created a budget for 2024 based on the assumption that Proctor sales will disappear entirely, which is very conservative. Any additional revenue we bring in, if we surpass those conservative assumptions, will go toward paying down the high-interest debt. My hope is that by this time next year, at least 1/3 of it will be paid off.

Most importantly, I have hope again. For the first time in a long time I feel like I’m running a manageable operation, something that fits my life, not constantly chasing the dream of growth that exceeds my capacity.

Stay small, friends. Trust me on this one.

Wow, what a fascinating read. Thank you for sharing your story with such honesty and humility! You really are inspiring, my friend.

Super interesting read (especially as a Tacoman!). I’m stoked to check out the South Tacoma location - I drive by it often when I go to Howdy Bagel (RIP). Thanks for mentioning them ❤️